Company

Company

21 Jul 2021

Orchard’s Newly Renovated and Extended Landmark Camberley …

News

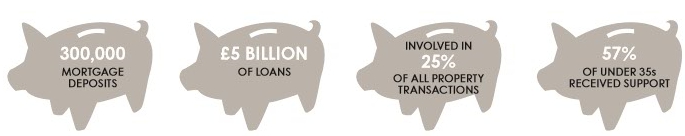

The ‘bank’ of mum and dad is one of the top ten mortgage lenders in the UK, according to research by Legal and General. On average, parents will provide £17,500 towards a deposit, and up to £24,000 to help support a first time buyer. Whether lending, gifting or

acting as a ‘helper’ or guarantor, 40.5% of prospective buyers across the South East anticipate they will need support from family and friends to purchase in the future as house prices have outpaced inflation and wage increases.

14% more loans were issued to First Time Buyers (FTBs) between April and June 2016 than a year ago, according to data recently published by the Council of Mortgage Lenders. Borrowing to FTBs reached £13.7 billion, up 21% on a year ago. With FTBs tempted back to the market after the investor rush in Q1, the average price of a FTB home (a property with two or fewer bedrooms) was £188,237 in August, a slight drop of 0.8% on July (Rightmove). On average, a FTB across the South East borrows 81% of purchase price, with a loan of around £181,000.

Lets get started! Our valuations are based on our extensive knowledge of the whole of the market.

Get a valuation